Accessing a tax offset through research and development

The Federal Government has introduced a new Research and Development (R&D) Tax Incentive for companies to flex their innovative ideas.

Introduced in 2017, the Federal Government’s R&D Tax Incentive provides a refundable tax offset for companies who are looking into new and innovative ways to improve their operations, and that of the wider industry.

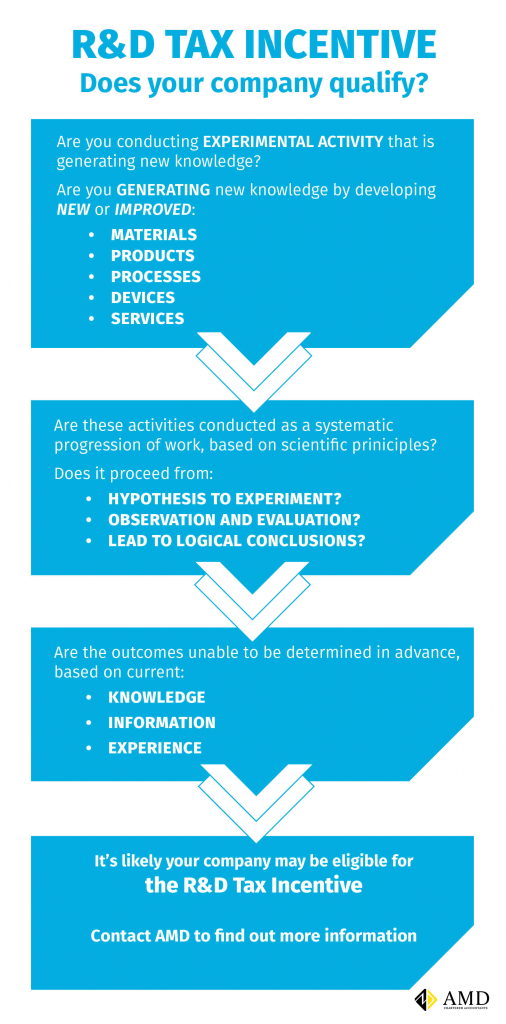

Companies who conduct a wide variety of experimental and scientific discovery are eligible, including improved:

- Materials (e.g. cooking mixes, concrete formulas, alloy compositions)

- Products (e.g. concrete product with enhanced setting properties)

- Processes (e.g. improved ethanol productions, improved wine fermentation)

- Devices (e.g. efficient ethanol production facility)

- Services (e.g. new SMS portal service)

The R&D Tax Incentive provides a 43.5% refundable tax offset for companies with a group turnover of less than $20 million pa. For companies with a turnover of more than $20 million pa, they will have access to a 38.5% non-refundable tax offset.

Sounds simple, right? Not quite.

There are a number of conditions, including the way companies conduct and catalogue their research. However, thankfully AMD is here to help.

Our Tax Services consultants would be more than happy to discuss how the R&D Tax Incentive could benefit your business – give us a call!