Taxable Payments Annual Report Financial Year Bookkeeping

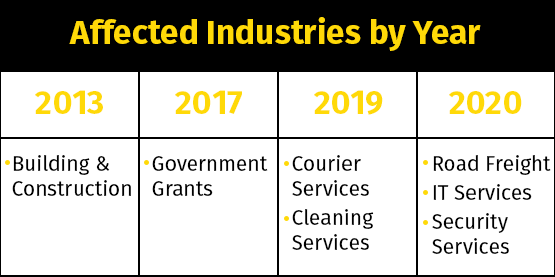

The Taxable Payments Annual Reporting (TPAR) informs the Australian Taxation Office (ATO) about payments that are made to contractors for providing services.

Contractors can include subcontractors, consultants and independent contractors. They can also be operating as sole traders (individuals), companies, partnerships or trusts.

The ATO uses this information to identify contractors who haven’t met their tax obligations.

What has to be reported?

A TPAR report requires the business to outline:

- the contractor’s name (that appears on the invoice the contractor provided)

- the contractor’s Australian Business Number (ABN)

- the contractor’s address (if known)

- the total amount paid or credited to the contractor over the income year

- the amount of any Goods and Services Tax (GST)

Thankfully, most of this information is already captured in the day-to-day bookkeeping processes. It may just mean that clients/bookkeepers need to be more diligent in capturing ABNs for suppliers and flagging those suppliers or employees (if a voluntary agreement is in place) that are reportable and assigning the payments into a separate account on the chart of accounts.

Who can report?

Tax Agents and BAS Agents can advise, prepare, and lodge the TPAR, while business owners can also prepare and lodge the report. The bookkeeper can assist the owner to prepare the report but may not lodge the report directly.

Prepare and lodge TPAR

The form must be lodged either electronically or via the ATO paper form.

To lodge the Taxable Payments Annual Report using electronic transfer, you need to create an electronic annual report data file using accounting software.

TPAR lodgement date is 28 August each year.

For more information or assistance regarding your TPAR – including whether you’re eligible to lodge a Nil Report – book an appointment to speak with one of our professional team members.